Autotech & Mobility Report 2H2024

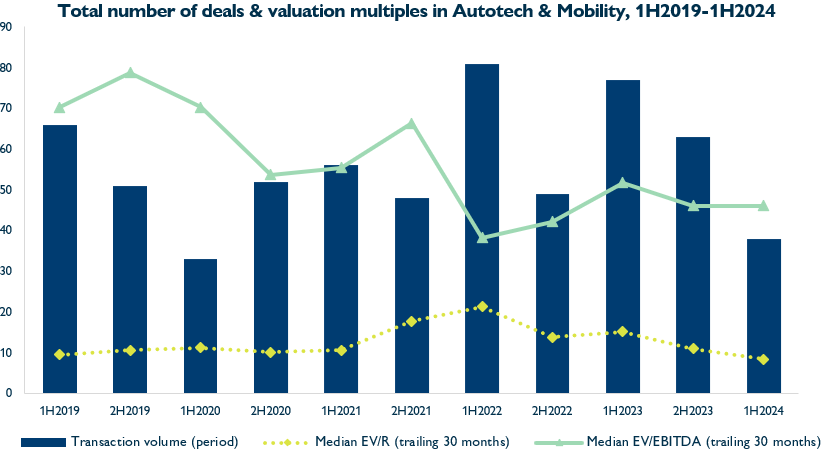

Our latest Autotech & Mobility M&A report reveals that 38 deals took place in 1H2024. This is the second consecutive decline in half-year deal numbers since the 77 transactions recorded in 1H2023, which was the second-highest volume on record.

The shift in activity reflects a general caution among investors and acquirers, with macroeconomic and geopolitical pressures instilling a more risk-averse approach. However, soaring global sales of electric vehicles, which reached a record-high in Q2 2024, together with the concurrent demand for next-gen automotive technologies such as ADAS and vehicle-to-everything (V2X) systems, indicate that the Autotech M&A market is poised for an upwards trajectory.

This report focuses on Autotech subsectors such as Enterprise Applications, Embedded Software & Systems, Internet Commerce & Content and Mobility & Fleet Management. It includes:

- Trends and analysis of deal activity

- Deal geography

- Top acquirers

- Valuation metrics

Top Buyers

The above graph covers the period between January 2019 and June 2024. Throughout this M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year.