Healthtech Report 2H2025

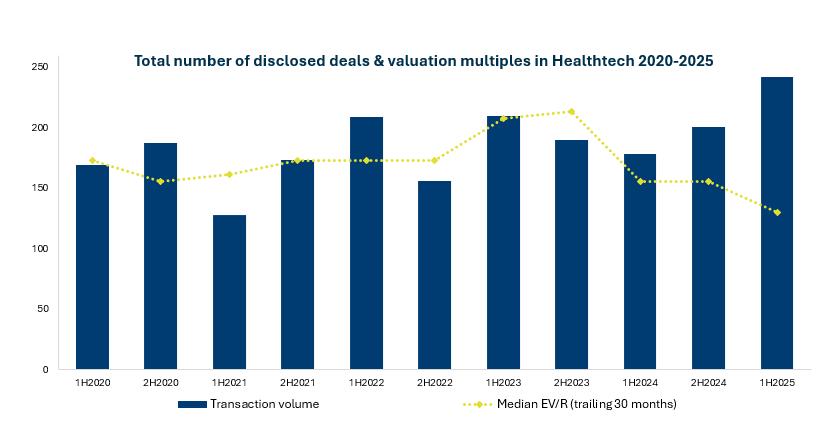

Our latest HealthTech M&A report highlights a promising resurgence in deal activity during the first half of 2025, an encouraging sign of renewed confidence in the sector, despite ongoing economic headwinds. Following a subdued period marked by rising costs, workforce shortages, and limited access to capital, the market experienced a notable rebound at the beginning of the year.

While deal volume increased significantly, average revenue multiples declined; indicating a market increasingly shaped by selective buyers, shifting valuation benchmarks and instances of distressed sales.

At the core of current M&A activity are AI-driven innovations. Additionally, investors and acquirers are placing growing emphasis on platforms that enhance diagnostics, drug discovery, and operational efficiency. Strategic buyers continue to lead the market, accounting for 69% of all transactions, a reflection of the intensifying race to integrate scalable technologies in artificial intelligence, telemedicine, and remote care. At the same time, financial sponsors remain active, pursuing minority investments and buy-and-build strategies, particularly in fragmented segments such as digital therapeutics and mental health.

Key topics covered in the report include:

- M&A trends and market dynamics

- Strategic vs. financial buyer behavior

- Regional transaction volumes and valuation shifts

- Valuation insights and key metrics

- Spotlight transactions and acquirer profiles

Top Buyers

The above graph covers the period between January 2020 and June 2025. Throughout this M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year.