Digital Commerce Report 2H2025

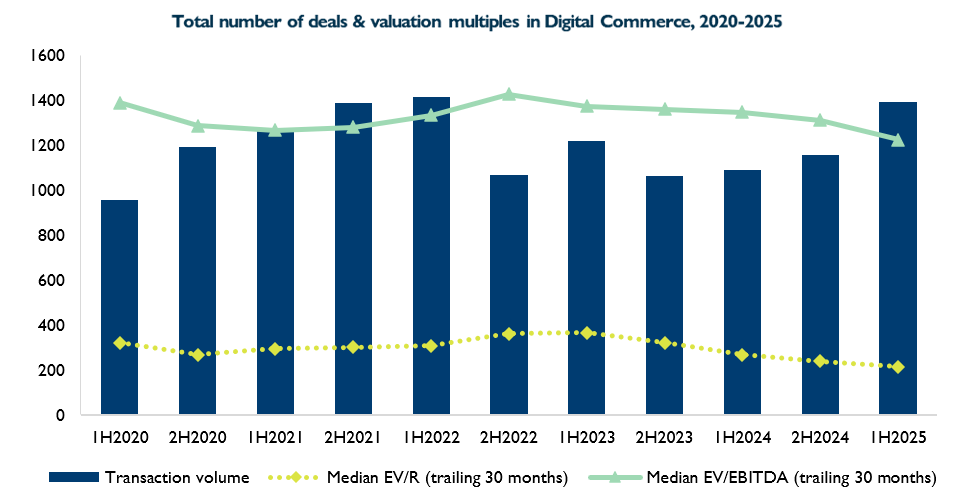

Our latest Digital Commerce M&A report reveals a significant rise in dealmaking in 1H2025, with 1,391 transactions recorded, representing a 22% year-on-year increase. This marks the second-largest deal volume recorded, surpassed only by the pandemic-driven surge in 1H2022, which saw a temporary spike in e-commerce demand.

The ongoing momentum is now fueled by more fundamental shifts in the industry, primarily driven by the AI trend. From generative AI reshaping online shopping experiences to AI-powered business agents transforming B2B sales, Digital Commerce is undergoing a technological transformation that’s expected to reshape the sector in the coming years.

Strategic buyers and financial investors are racing to invest in transformative technologies, with acquisitions serving increasingly as a means of innovation and staying competitive in this rapidly changing ecosystem. The growing role of AI in driving digital commerce is setting the stage for a new M&A wave, expected to gather further momentum in 2026.

The report covers key subsectors within Agencies & Service Providers, Digital Commerce Software, Internet Services & Portals, Online Retail, Media, Social & Gaming.

Key topics addressed in the report include:

- Trends and analysis of M&A activity

- Transaction overview by region

- Most active acquirers and deal highlights

- Valuation insights and metrics

Top Buyers

The above graph covers the period between January 2020 and June 2025. Throughout the M&A report, median “trailing 30-month” multiples plotted in the graphs refer to the 30-month period prior to and including the half year or quarter.